do you have to pay inheritance tax in arkansas

The will must be filed with the circuit court in the county where the decedent lived. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

Arkansas Estate Tax Everything You Need To Know Smartasset Estate Tax Estate Planning Inheritance Tax

As of 2021 the six states that charge an inheritance tax are.

. This means that a beneficiary inheriting property in Arkansas will not owe any inheritance tax. Arkansas Estate Tax. Delivery Spanish Fork Restaurants.

You would receive 950000. Arkansas does not collect an estate tax or an inheritance tax. Inheritance tax of up to 18 percent.

Other Necessary Tax Filings. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. The percentage can range from 0 to 18 and there may be different rates for different types of property.

Arkansas does not have a state inheritance or estate tax. Petition for probate may be filed at the same time. Arkansas also has no inheritance tax.

They must be followed to ensure the estate is distributed as required by law. States such as Iowa New Jersey Kentucky and Pennsylvania collect inheritance tax. Although there is no Arkansas estate tax or inheritance tax beneficiaries may have to pay federal tax on money they receive.

You will also likely have. The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that has an inheritance tax. You will also likely have to file some taxes on behalf of the deceased.

Many of the steps for probate in Arkansas are the same as in other states. However any income you receive from an estate or thats generated from the property you inherit will be treated as taxable income or capital gains. It is one of 38 states in the country that does not levy a tax on estates.

The state income tax rates range up to 59 and the sales tax rate. Does Arkansas Have An Inheritance Tax. Everything You Need to Know - SmartAsset There is no estate tax in Arkansas.

There is a federal estate tax that may apply Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying. Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. Since an inheritance isnt considered taxable income you do not need to report it on your tax return.

Inheritances that fall below these exemption amounts arent subject to the tax. The estate would pay 50000 5 in estate taxes. Having a knowledgeable estate attorney can help make navigating.

Settling an Estate in Arkansas. When you die there are many federal and estate tax situations that need. An attorney can tell you about the benefits of a living trust or other legal tools which may reduce the size of the estate that has to go through probate.

The amount of inheritance tax that you will have to pay depends on. However if you are inheriting property from another state that state may have an estate tax that applies. The state of Arkansas requires you to pay taxes if youre a resident or nonresident that receives income from an Arkansas source.

The laws regarding inheritance tax do not depend on where you as the heir or beneficiary live. Essex Ct Pizza Restaurants. Inheritance tax rates differ by the state.

Arkansas does not collect inheritance tax. Heres how estate and inheritance taxes would work. Surviving spouses are always exempt.

Do You Have To Pay Inheritance Tax In Arkansas. Arkansas does not collect an estate tax or an inheritance tax. State inheritance tax rates range from 1 up to 16.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. Opry Mills Breakfast Restaurants. However if you are inheriting property from another state that state may have an estate tax that applies.

Income Tax Rate Indonesia. The median amount paid on homes valued at 266200 is just under 2800. Soldier For Life Fort Campbell.

This does not mean however that Arkansas residents will never have to pay an inheritance tax. The state in which you reside the size of the inheritance your relationship with the deceased Generally the tax is a percentage of the value of the property being inherited. These states have an inheritance tax.

Whether or not you have to pay inheritance tax depends on the state you live in the size of the inheritance and your relation to the deceased. You would pay 95000 10 in inheritance taxes. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

Youll need to report this on the relevant forms on your tax return. Restaurants In Matthews Nc That Deliver. However residents of Arkansas will have to pay inheritance tax if they inherit property from states that collect the tax.

Who has to pay. Even though Arkansas does not collect an inheritance tax however you could end up paying inheritance tax to another state. At the federal level there is no tax on.

Complete Guide To Probate In Arkansas

Arkansas Retirement Tax Friendliness Smartasset

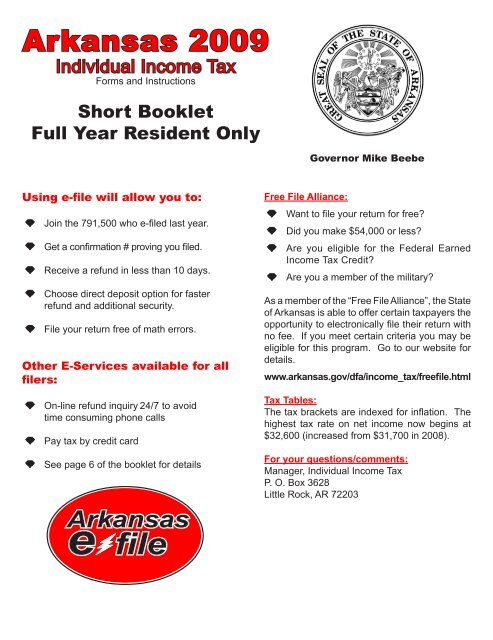

Individual Income Tax Arkansas Department Of Finance And

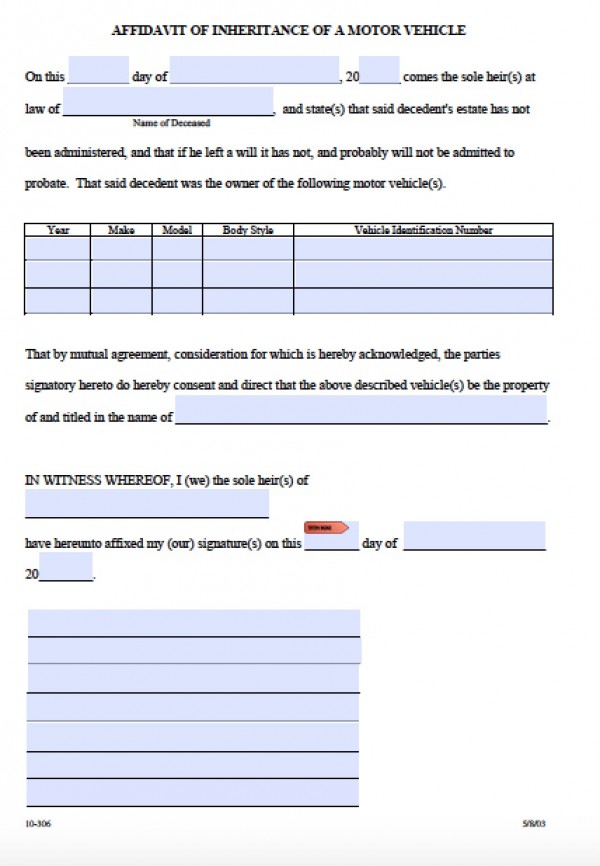

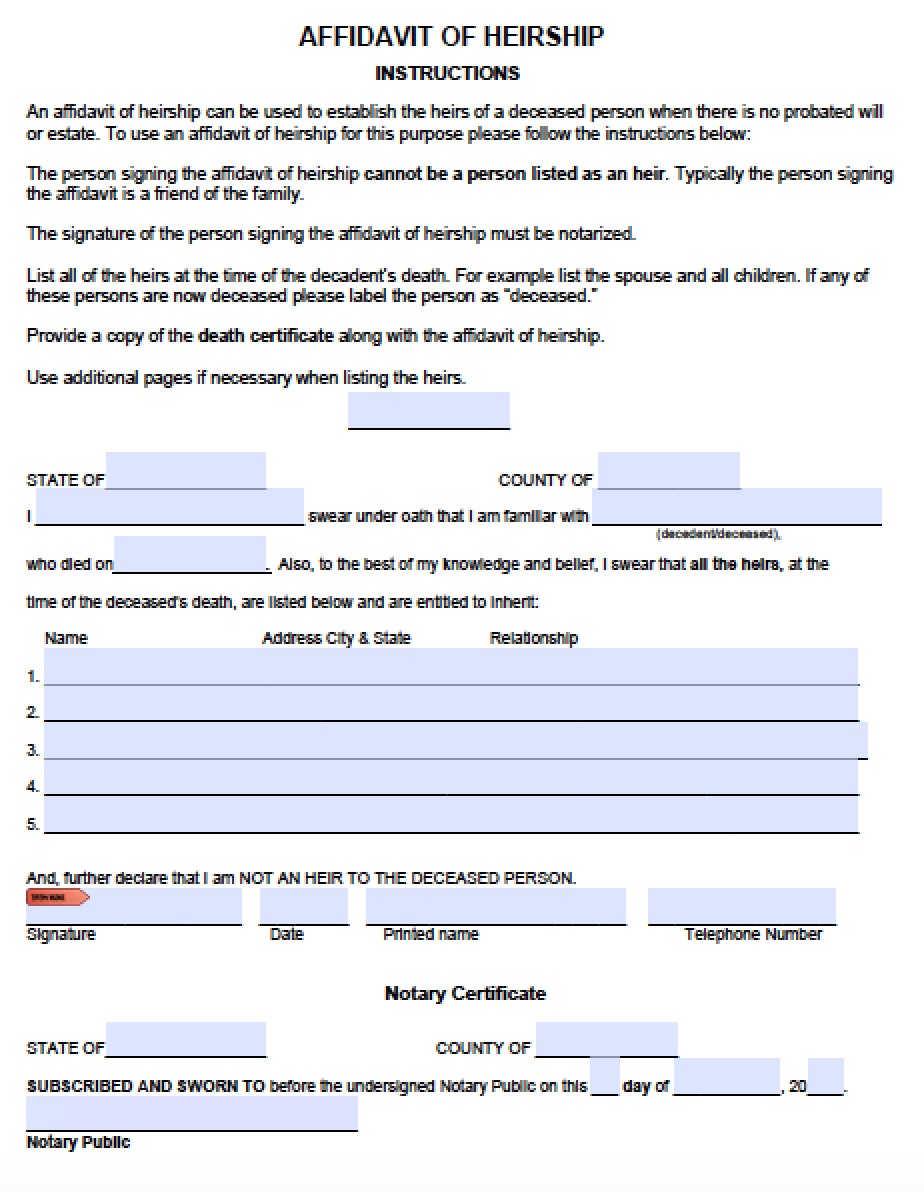

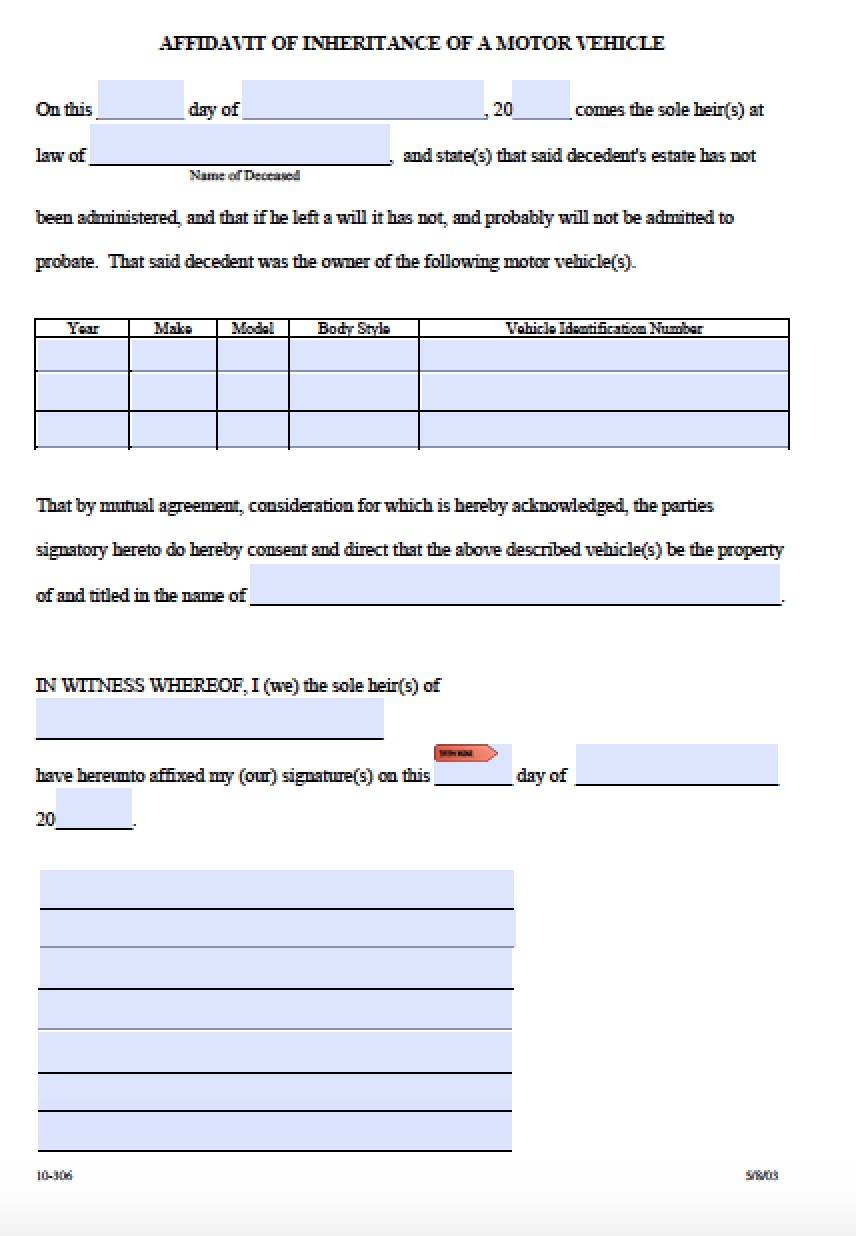

Free Arkansas Affidavit Of Inheritance Motor Vehicle Form Pdf Word

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Historical Arkansas Tax Policy Information Ballotpedia

Free Arkansas Affidavit Of Inheritance Motor Vehicle Form Pdf Word

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times

What Happens If You Die Without A Will In Arkansas Cake Blog

Where S My Arkansas State Tax Refund Taxact Blog

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

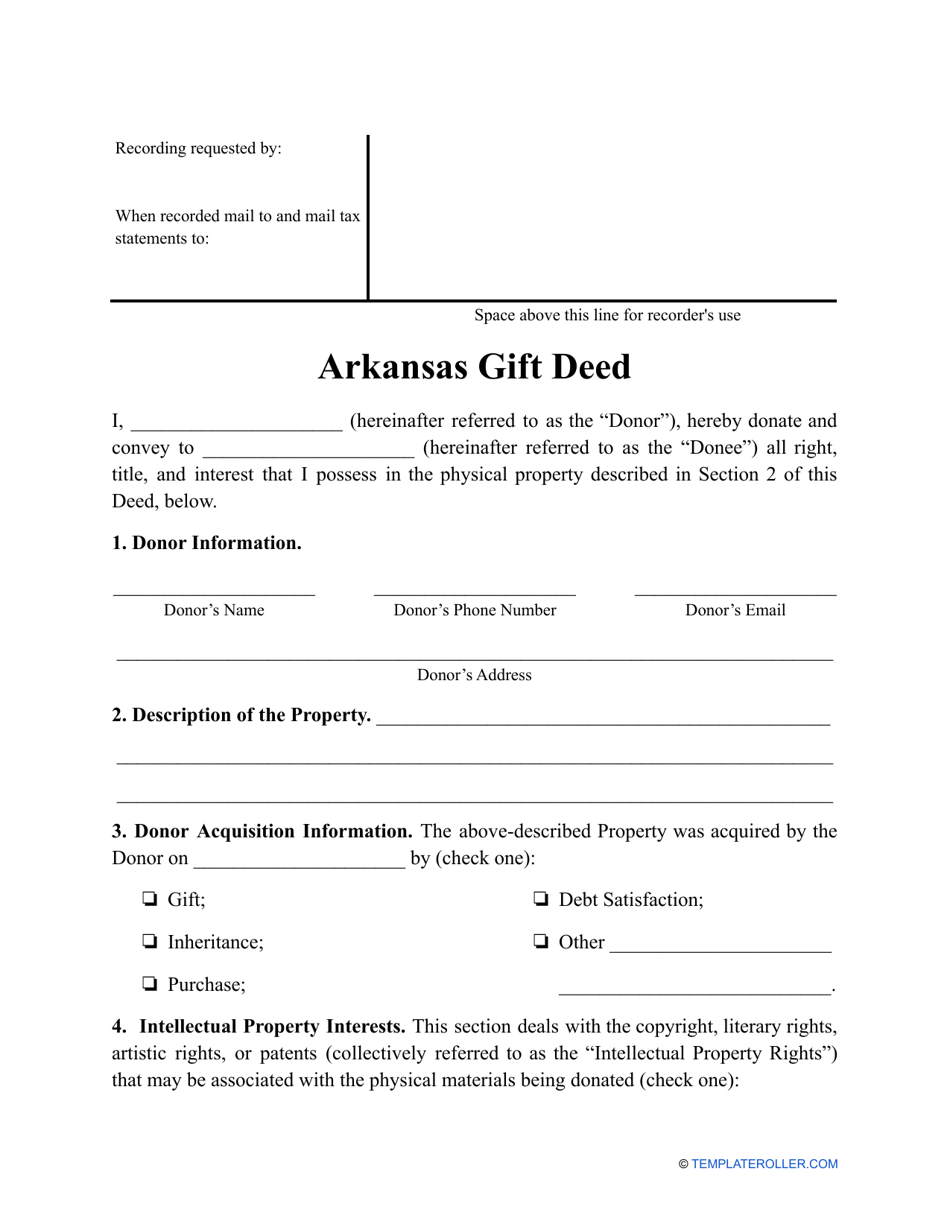

Arkansas Gift Deed Form Download Printable Pdf Templateroller

Is There An Inheritance Tax In Arkansas

Arkansas Inheritance Laws What You Should Know

Arkansas Inheritance Laws What You Should Know

Complete Guide To Probate In Arkansas

Free Arkansas Affidavit Of Inheritance Motor Vehicle Form Pdf Word

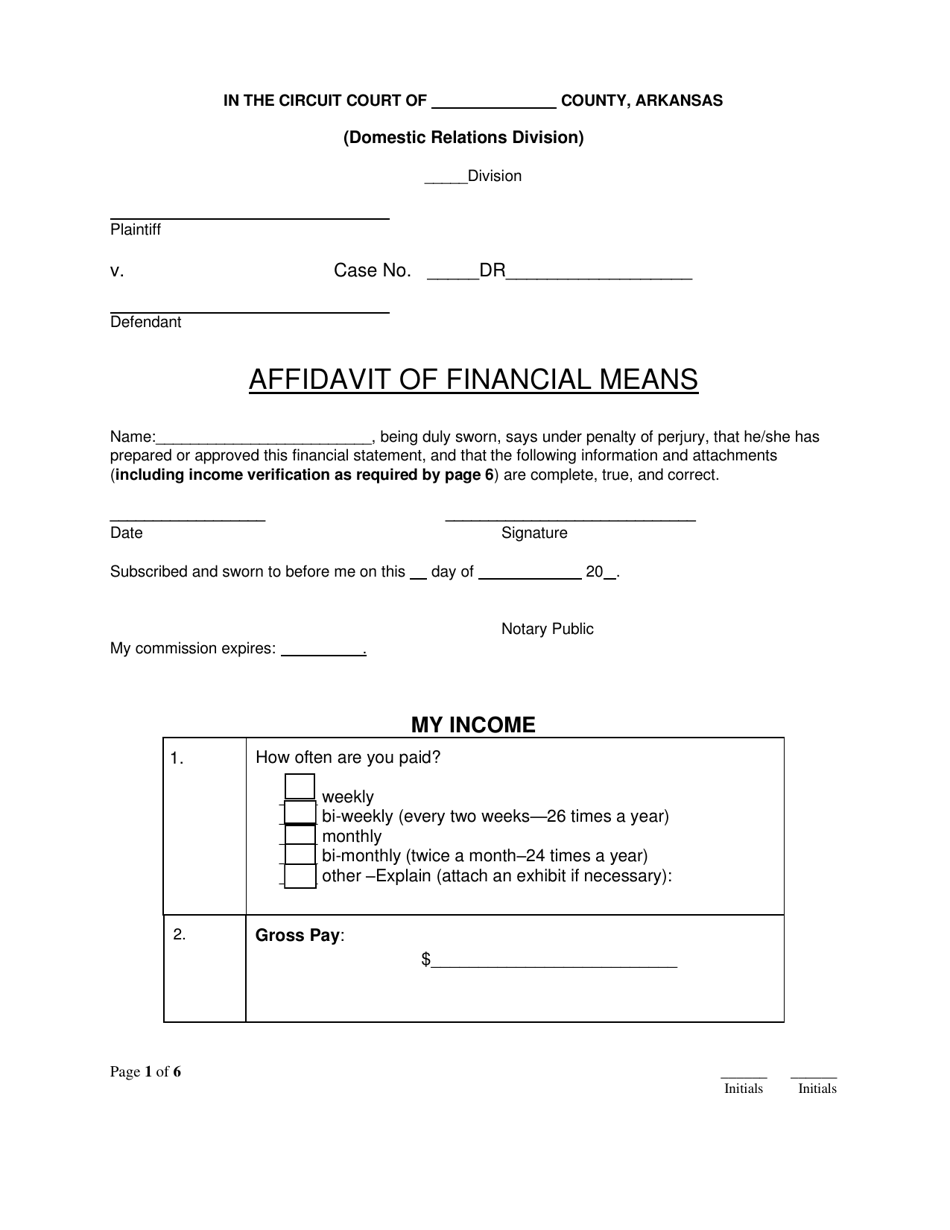

Arkansas Affidavit Of Financial Means Download Fillable Pdf Templateroller