capital funds tax services

Based on the duration for. Capital Gains Tax Example.

Any profit or gain that arises from the sale of a capital asset is a capital gain.

. Understanding how capital gains taxes work is an essential part. In the United States of America individuals and corporations pay US. Theyre taxed at lower rates than short-term capital gains.

In most cases youll use your purchase and sale information to complete Form 8949 so you can report your gains and losses on Schedule D. 31 2017 from being treated as capital. In the case of listed shares and equity-oriented mutual funds a long-term capital gain arises if they are sold after holding it for one year only and short-term capital gain if sold within one year.

Given the 2023 federal income tax rates and assuming you are filing as a single person you would be in the 22. Net operating income is the sum of all profits from rents and other sources of ordinary income generated by a property minus the sum of ongoing expenses such as maintenance. Roth IRAs and 401k plans take this one step further.

Harvesting capital gains is the process of intentionally selling an investment in a year when any gain wont be taxed. Singh must pay Rs. The 0 long-term capital gains tax rate has been around since 2008 and it lets you take a few steps to realize tax-free earnings on your investments.

Financial capital also simply known as capital or equity in finance accounting and economics is any economic resource measured in terms of money used by entrepreneurs and businesses to buy what they need to make their products or to provide their services to the sector of the economy upon which their operation is based eg retail corporate investment banking etc. If collectibles are held over one year long-term sales are taxed at the collectibles capital gains tax rate capped at 28. The tax you pay on your investment income is called capital gains tax and the rules are different from your standard income taxes.

Capital Markets and Banking Explore our solutions and services Transform your securities operations and achieve your target operating model with our cutting-edge high-impact tech solutions and services. Understanding the Wash Sale Rules On Tax Loss Harvesting TLH The so-called wash sale rules are one of the oldest anti-abuse provisions of the Internal Revenue Code first originating with the Revenue Act of 1921 and substantively codified in the current IRC Section 1091 as a part of the general overhaul in developing the Internal Revenue Code of 1954. Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps are taxed at a maximum rate of 28.

The capital gains tax on sale of land will be Rs. Now lets analyse the tax rate applicable to income from these assets such as property gold jewellery shares etc. 174000 as tax on LTCG.

Even taxpayers in the top. A business investment loss is defined under paragraph 391cThe fraction in section 38 that applies for a tax year currently one-half is referred to in this Chapter as the inclusion rateIn other words if the business. If approved funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund reducing the.

Our Goods Services Tax course includes tutorial videos guides and expert assistance to help you in mastering Goods and Services Tax. Financial services are the economic services provided by the finance industry which encompasses a broad range of businesses that manage money including credit unions banks credit-card companies insurance companies accountancy companies consumer-finance companies stock brokerages investment funds individual asset managers and some. Debt Funds At tax slab rates of the individual At 20 with indexation.

Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being sold. Clear can also help you. Long-term capital gains are gains on assets you hold for more than one year.

If the ordinary rate is lower use it That rate is higher than the top regular long-term capital gains rate of 20 2020 and 2021. Unlike federal capital gains taxes Californias capital gains tax rate for 2022 is not based on whether the gain is short-term or long-term. Stonehenge is a thought leader in investment capital producing strong returns for investors and impactful social returns for communities.

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Capital Gains Tax. Clear can also help you in getting your business registered for Goods Services Tax Law.

More help with capital gains calculations and tax rates. Stocks bonds mutual funds and real estate are among the assets that are subject to this California capital gains tax rate. If Joe sells an asset that produced a short-term capital gain of 1000 then his tax liability rises by another 120 ie 12 x 1000.

We do this by fostering collaboration among our team of talented professionals who leverage two decades of expertise and relationships to provide innovative financing solutions delivering a variety of debt and equity financings to spur. Since retirement account funds are able to grow on a tax-deferred basis the account balances may grow even more than they would if capital gains taxes were assessed pre-retirement. This occurs in years when youre in the 0 capital gains tax bracket.

Capital gains taxes arent assessed even when funds are withdrawn in retirement as long certain rules are. Unlisted equity space. Lets use our above example of a 90000 salary and 10000 short-term capital gain.

Income Tax vs. Yes under the IT Act there are a few ways to help landowners reduce their capital gains tax liability. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0.

Save taxes with Clear by investing in tax saving mutual funds ELSS. Introduction to business investment losses. Are There Deductions Available for Reducing Capital Gains Tax.

Tax Audit Notice Services include tax advice only. Real estate properties may generate revenue through a number of means including net operating income tax shelter offsets equity build-up and capital appreciation. The capital gains you earn from equity funds are subject to capital gains tax.

Capital gains tax rates and dividend tax rates. Due to the close-ended nature of most AIFs in category I and. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and the amount of time the investment was held.

That means you pay the same tax rates you pay on federal income tax. Generally the Venture Capital Funds category comprises funds that invest in early-stage technology businesses. In this situation the tax will be 20 of 870000.

However it was struck down in March 2022. Current California Capital Tax Gains Rate Vs Previous Years. The Tax Cuts and Jobs Act passed in December 2017 excludes patents inventions models designs patented or not and any secret formulas sold after Dec.

A separate agreement is required for all Tax Audit Notice Services. Eligibility criteria and underwriting. 11 An allowable business investment loss is defined in paragraph 38c as one-half of a business investment loss.

Short-term capital gains are taxed at the ordinary rate. You have either short-term or long-term capital gains depending on the holding period of your investment.

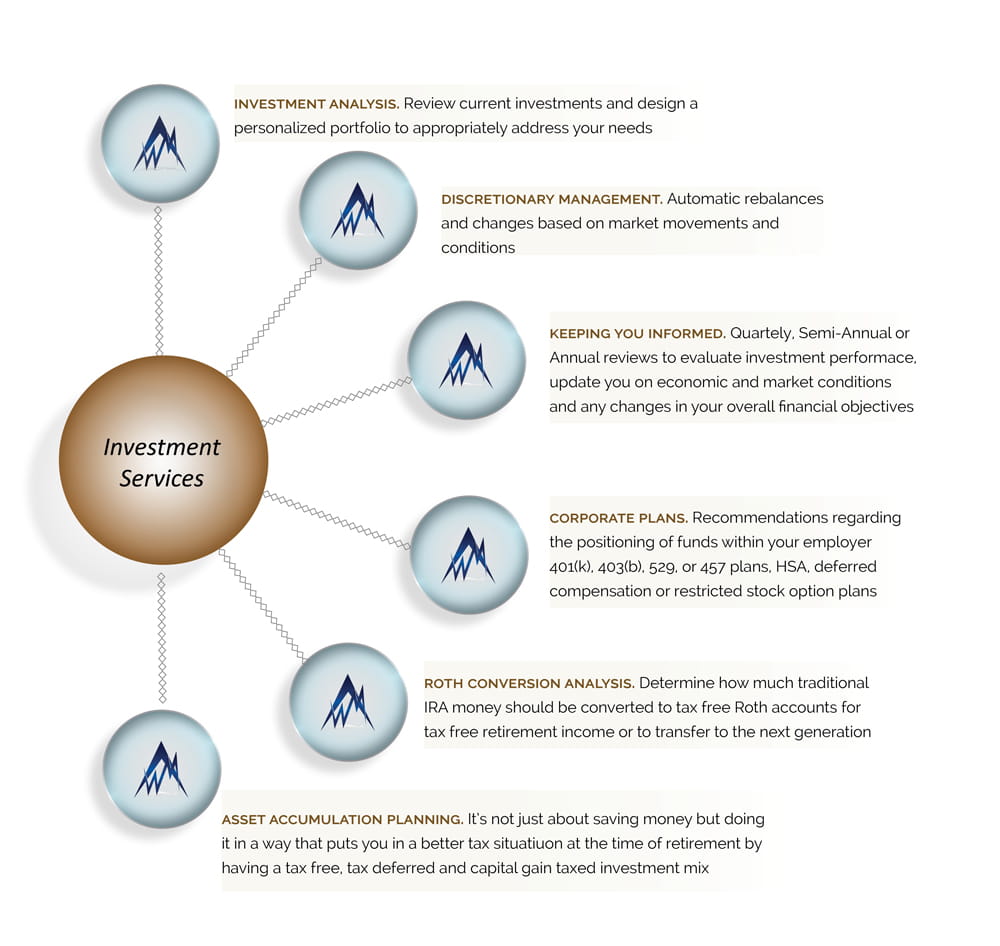

Alliance Wealth Management Milwaukee Our Services

Start A Venture Fund Angellist Venture

Covid 19 Mansfield May Need To Dip Into Rainy Day Fund In 2021 Due To Revenue Declines News Richlandsource Com

Capital Funds Tax Services Alexandria Va

Selling Stock How Capital Gains Are Taxed The Motley Fool

Dagres Ordinary Loss For Bad Debt Of Private Equity Fund Manager International Tax Blog

About Leo Berwick M A Tax Advisory Professionals

Online Tax Filing Services E File Tax Prep H R Block

Capital Funds Tax Services Alexandria Va

Start A Venture Fund Angellist Venture

Capital Funds Tax Services Alexandria Va

How To Give To Charity In The Most Tax Effective Way

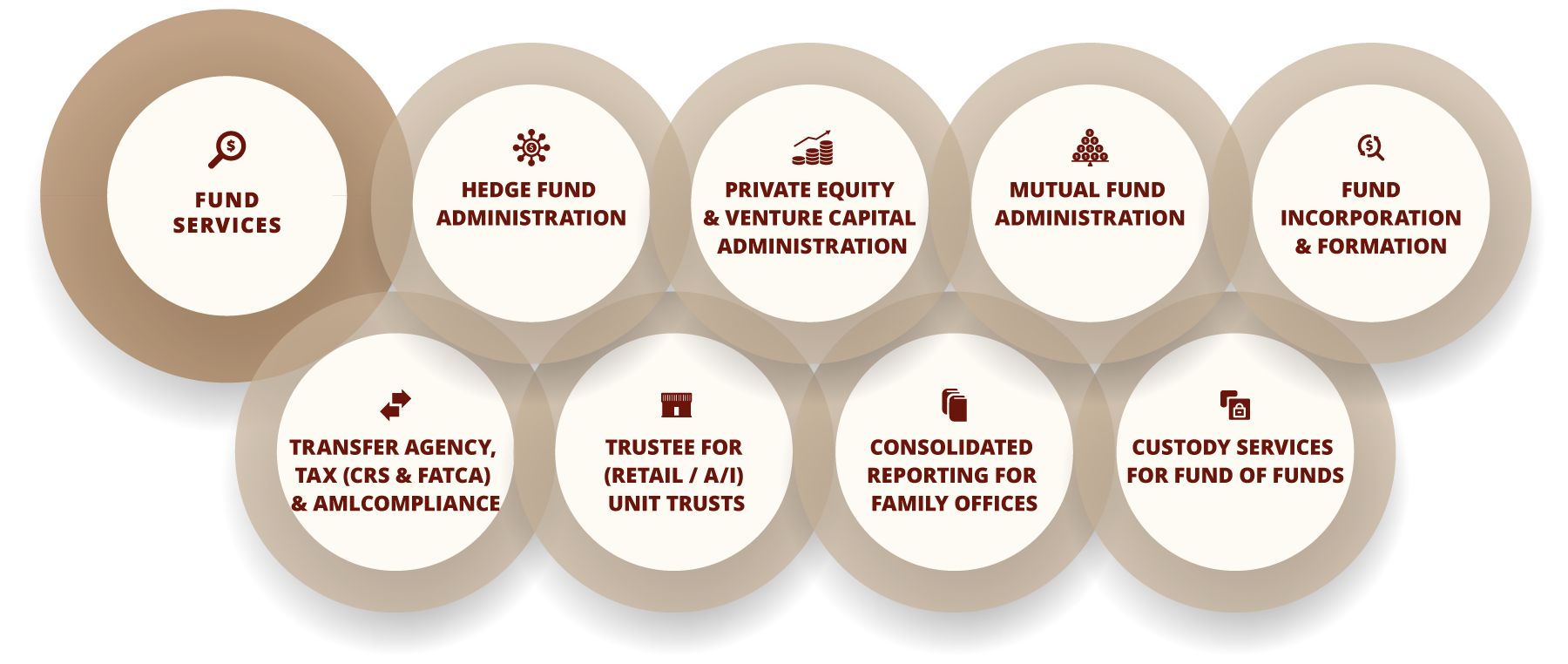

Fund Services Portcullis Group

What Is Carried Interest And How Is It Taxed Tax Policy Center

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)